Regarding the Stefanie

Stefanie first started the lady occupation since the a journalist, reporting into options, futures, and you can retirement finance, and more than has just spent some time working since a writer and you can Seo stuff strategist in the a digital purchases service. Inside her time, she have exercises Pilates and you can spending time with their girl and you may Siberian Husky.

Home ownership try a system. Very home buyers usually do not spend bucks due to their residential property, so they really need to take aside a home loan and make payments for quite some time before they could state that they have it outright. All of men and women repayments really helps to build collateral, the part of the full worth of your house that the customer control. You to collateral are a valuable asset.

Property security financing try a guaranteed financing where the security ‘s the guarantee the domestic visitors has generated up-over day. House collateral financing are applied for to complete home improvements or even complete difficult financial points. They may be able be used to own debt consolidation reduction. On this page, we’ll define exactly how that actually works and you can be it a good idea.

- Try home equity financing perfect for debt consolidation?

- Advantages of using a home equity financing getting debt consolidation reduction

- Cons of utilizing a property security mortgage to possess debt consolidation

- Whenever property security mortgage is reasonable

- Whenever a house equity mortgage isn’t best

- Being qualified getting property security loan

- Procedures to try to get property equity loan getting debt consolidation

- Domestic collateral financing against consumer loan to own debt consolidation reduction

- HELOC to possess Debt consolidating

Are family equity money best for debt consolidation?

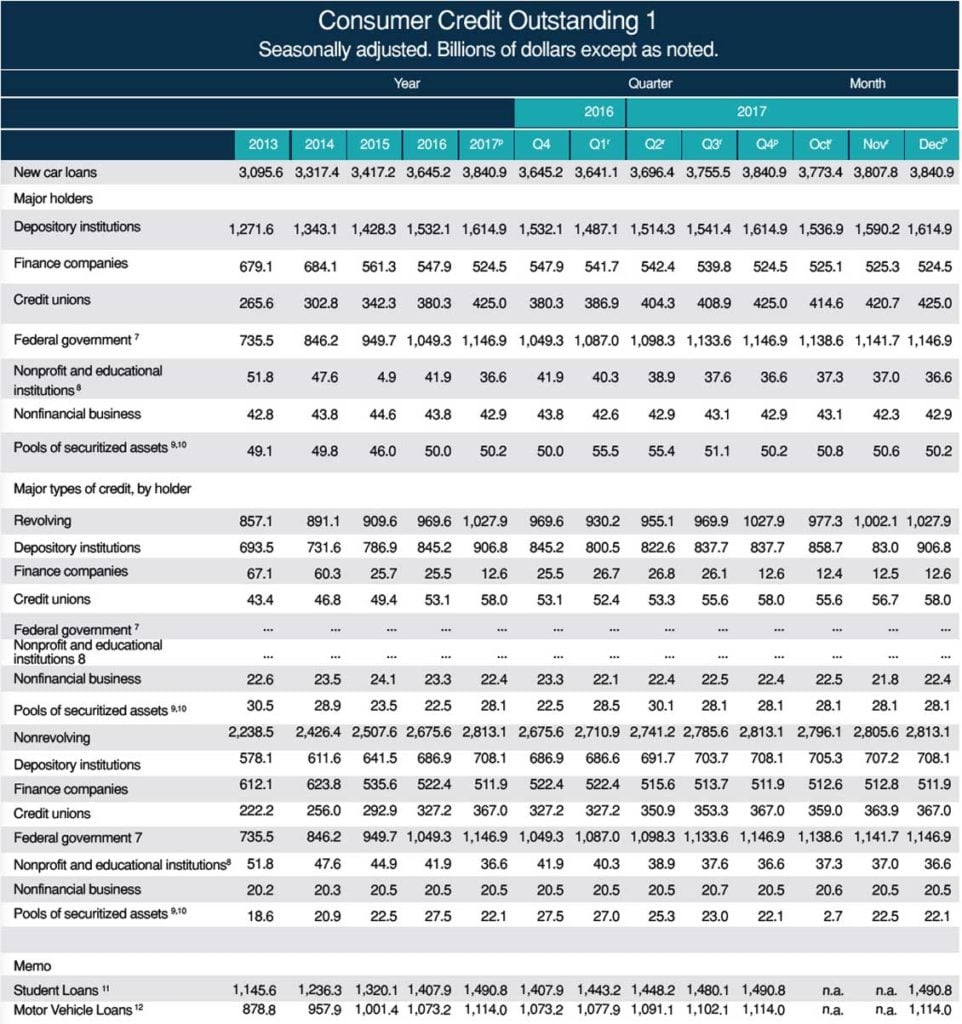

Debt consolidation reduction concerns lowering interest levels. Mastercard rates was high. Household equity financing rates of interest are usually straight down, because they’re secured personal loans, than other financing facts, and attention payments can be tax-deductible. That makes this type of financing helpful for merging large interest personal credit card debt and you can streamlining expenditures.

There are positives, but it is also important to know the dangers. Borrowing up against your property puts your house at risk for foreclosure if you fail to make your payments. Careful monetary thought will be predate one attempt to pull out a house collateral mortgage. A keen unsecured consumer loan could well be a much better option, even though interest levels is higher.

Various other possibilities that have family collateral money is the fact assets viewpoints you will definitely lose inside the longevity of the borrowed funds. This might make citizen being upside-down and you will due more the home may be worth. Installment terms and conditions on the family guarantee finance would be ten years or stretched, therefore assets beliefs will most likely changes. Check business forecasts one which just operate to find out if they’ve been attending go up.

Positives of utilizing a property collateral mortgage having debt consolidating:

Interest rates into the domestic equity fund are much below other sorts of debt, such as playing cards. This is because household collateral money try secured loans, which means that you are offering collateral into the bank.

Household guarantee fund normally have extended installment symptoms than many other types out of financing, so your monthly payments might possibly be lowered.

Unlike fretting about payment dates and costs getting multiple expenses, possible only have to care about spending you to per month.

The attract would be tax-deductible in the event your financing will be used to change your house’s value i.elizabeth. strengthening a connection otherwise remodeling the kitchen. Anything else the borrowed funds can be used having will not be deductible.

Due to the fact you might be offering your house since the security for the lender, your twist quicker risk towards lender and you may usually don’t need an excellent higher credit rating to help you meet the requirements. Yet not, higher score will generally support top rates.