Know how A home loan App Will get Analyzed and you can Certified

So you have fundamentally decided to take the plunge and buy an excellent https://paydayloancolorado.net/hotchkiss/ new house. Ever wondered what goes on behind-the-scenes and you may exactly what the inquiries, qualifications and you will points is actually which make the difference between an approval and you may denial?

As the our very own objective will be to deliver the neighborhood that have devices and training and also to allow people becoming a knowledgeable, education and you will energized user, here we will render an overview of how a keen underwriter analyzes an application (AKA the one who find toward result of your application). Weekly, we will identify for every grounds/C in depth therefore look for our inserts a week!

The cuatro C’s out of Underwriting- Borrowing, Capabilities, Guarantee and you will Investment. Guidance and you may exposure tolerances alter, however the key conditions dont.

Credit

Credit… the new dreadful phrase! The truth is, the number trailing your credit score does not need to feel particularly a puzzle.

Credit is the forecast off a great borrower’s repayment considering the analysis of its earlier in the day credit payment. To decide a keen applicant’s credit rating, lenders will use the middle of the 3 credit scores stated because of the three credit bureaus (Transunion, Equifax, & Experian).

By the evaluating a person’s monetary activities, such as for instance commission background, full loans versus total offered debt, the types of financial obligation (revolving borrowing from the bank versus. fees financial obligation a good), a credit score is offered for each and every debtor and that shows your chances of well managed and you will repaid obligations. A top rating tells a loan provider that there surely is a reduced exposure, which results in a far greater price and you will label to the borrower. The lender will appear to perform credit early on, to see just what demands get (or might not) present themselves.

Capacity

Including examining a keen applicant’s borrowing from the bank, lenders should analyze their ability to repay the borrowed funds more than go out. Ability is the data away from contrasting an excellent borrower’s income to their obligations. An important unit they normally use because of it studies is a debt-to-income ratio. This basically means, your debt-to-earnings proportion is the sum of every payment personal debt an candidate enjoys (including the possible after that property fee) split because of the their terrible monthly income.

Although not, remember every application is additional. Request a home loan Mentor to determine the way the underwriter often determine your own wide variety.

Collateral

It’s usually over through the appraisal of your house. An appraisal takes into account of numerous items conversion from comparable house, located area of the home, measurements of your house, standing of the property, rates to reconstruct our home, as well as leasing earnings choice. Obviously, the financial institution will not foreclose (they’re not on real estate business!) however they do need to possess one thing to keep the loan, if your payments ends up (also known as standard).

Capital/Dollars

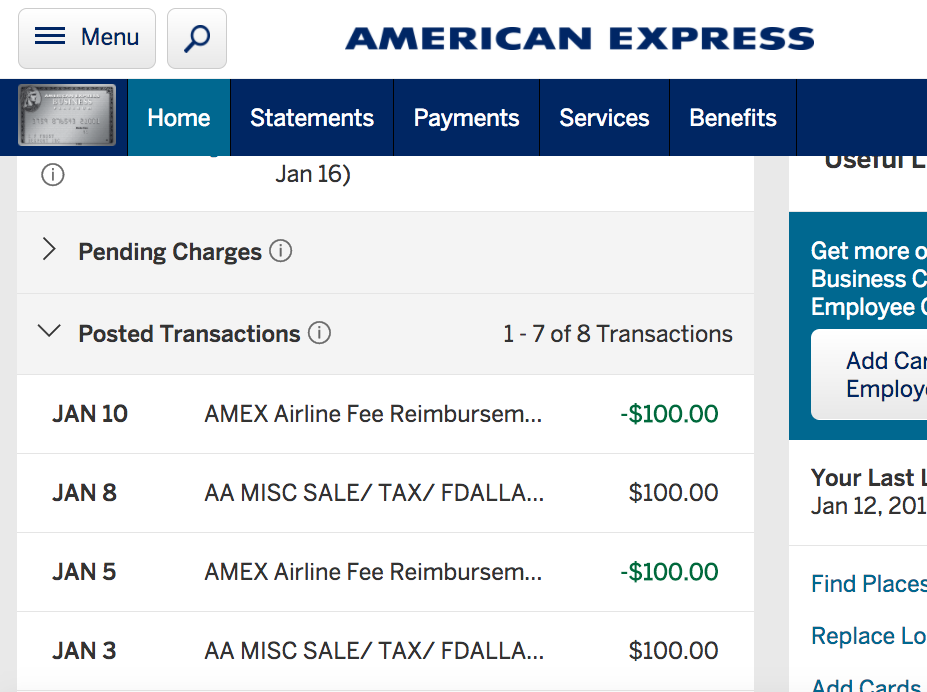

Financing are a look at your finances once you personal. There are two main independent parts right here money in the offer and money when you look at the reserves.

Money in supplies: Crucial factors to own a lender try: Does a candidate keeps an economic support to-fall right back into when the their income was abruptly disturbed to own an occasion? Has got the candidate found a routine and you may practice of saving cash throughout the years? Create he has funding membership which have quick assets you to a borrower you’ll availableness in the event the need-be?

Cash in the deal: To phrase it differently, the more of the currency in it, the new healthier the borrowed funds application. Meanwhile, the greater number of currency you have after closing, new not likely you are in order to default. A couple prospective consumers that each and every have the same money and you may borrowing ratings possess some other chance profile if one has $a hundred,100 once closing and almost every other has $100. Is reasonable, doesn’t it?

Each one of the 4 C’s are very important, but it’s truly the blend of them that’s key. Solid income percentages and you will a giant deposit can be stabilize specific borrowing from the bank activities. Likewise, good borrowing from the bank histories let higher ratios and you can good credit and you can income is defeat less down money. Talk openly and you will easily together with your Home loan Mentor. They are on your side, recommending for your requirements and seeking to build your loan because definitely that one may!