Individuals who dislike spending money on some thing

By way of example, you can purchase a totally free bank account at the BBVA . To have a bank checking account within a traditional brick-and-mortar bank, you may be thinking about $120 a year only in the monthly charge to utilize the brand new account, not at the BBVA.

If you need free some thing, youll like banking institutions you to pay You to own financial together. Their Hybrid Savings account pays you 1.00% APY for people who continue $dos,five-hundred on your own membership – compare that about what youll access a major conventional lender, that’s simply 0.01%. (Perhaps not a great typo: brand new federal average bank account interest is just one one-hundredth from a per cent. Ouch).

Freelancers or front hustlers

As previously mentioned a lot more than, bank accounts are located in besides on line or old-fashioned styles, however, private and company, as well. If the youre good freelancer or front hustler, We recommend one take a look at benefits of using a keen web based business bank account for the biz. They has actually your company money separate from your own personal currency, which will help your beat your efforts due to the fact a legitimate business. ( it helps make something means smoother at income tax date). If you’re always undertaking most, or all the, of one’s online business, you’ll likely appreciate doing your organization banking thanks to an on-line financial as well.

Not every team americash loans Thorsby family savings is good for the freelancer lifetime, although. Actually organization bank account available for small businesses can also be wanted highest every day balances otherwise highest monthly fees, hence tend to does not match performing a freelance business.

Youll be better out-of having a free online membership for the these circumstances. Novo , for instance, is a fantastic bank to work with. Its free to open a free account which have Novo plus they do not costs month-to-month costs, possibly. You could potentially link your very own checking account and you may plan for bills to-be repaid on Novo organization membership, next transfer the your income out to your personal membership. You might cover a few of your company earnings to have expenses taxation afterwards and its very easy to continue info, too. Also, for individuals who join Novo, theyll help you with discounts for software and you will characteristics youll in reality include in your business: thought Loose, Stripe, or Quickbooks.

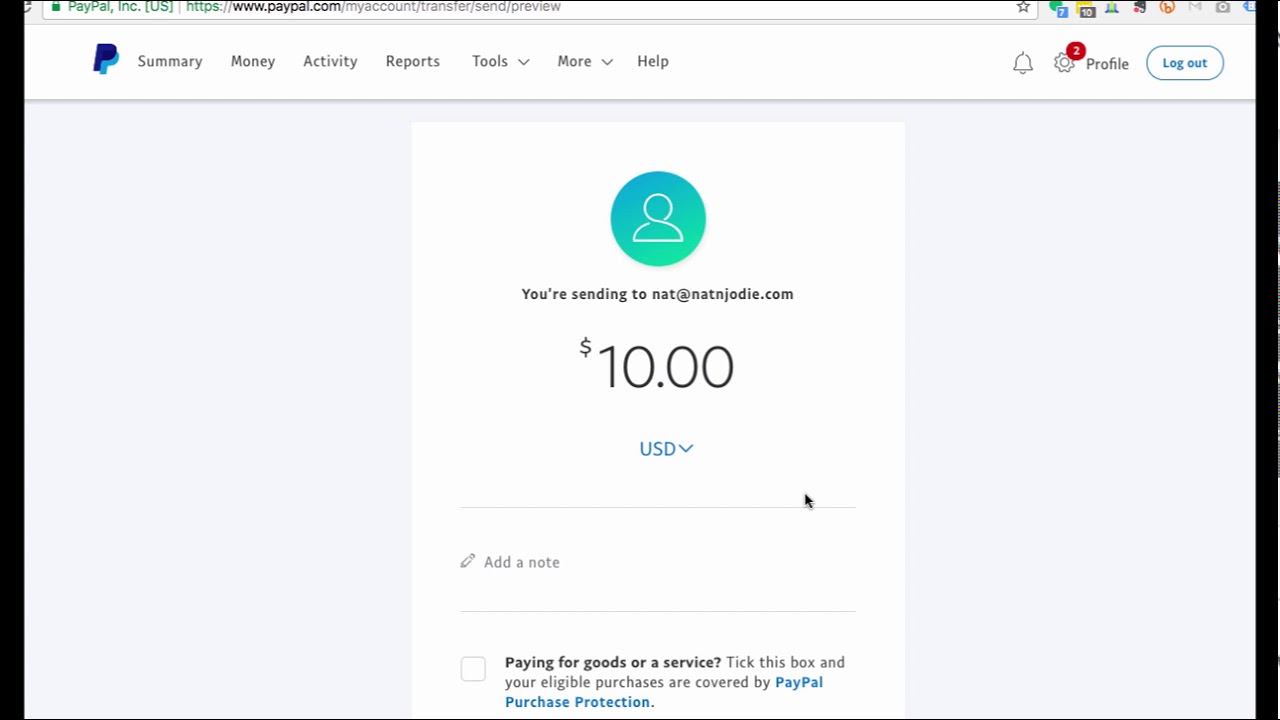

Novo offers an effective software that lets you display screen your debts, send and receive currency, pay bills, and you may import loans to connected accounts.

Opt for BlueVine a pals that provides each other a corporate savings account and you can finance to own small enterprises. Brand new BlueVine Organization Bank account brings limitless purchases, real time help, no monthly charges. Also, you can make 1.2% APY.

The organization funds front is sold with both a personal line of credit otherwise invoice factoring. With the line of credit, you should buy right up $250,000 in the borrowing, that have cost only cuatro.8%. Having invoice factoring, you can aquire an effective factoring line-up to help you $5 mil, with cost as little as 0.25%/day.

Why you ought to fool around with traditional banking institutions

Therefore, with all having said that, you may still find specific advantages to using conventional finance companies. If that is exactly what youre regularly, you’re lured to carry on since you will have come.

Private solution

For-instance, traditional banking companies can give you a great deal more individual solution. Depending on the financial you choose as well as the tellers one team the local branch, you can finish financial during the type of lay in which we know their label. The staff makes it possible to establish financial activities such as for instance money and you may playing cards and you will describe the way they works. If you’d like a personal reach with the financial experience, conventional banking institutions are definitely to your benefit.