Financial institutions doing work in the country bring area otherwise belongings finance so you can qualified people. This new finance will likely be availed to order a residential area in which you can make your dream family. He’s given at glamorous rates and will be paid off into the affordable EMIs toward maximum cost tenure increasing to help you 25 decades. Continue reading to learn more info on patch funds.

Plot Financing Interest 2022

Note: The new EMI is computed immediately after due to the loan amount to-be Rs.step one lakh, period are 120 weeks while the attract as being the reasonable as the mentioned on dining table more than.

Area Loan EMI Calculator

Playing with an enthusiastic EMI calculator will allow you to from inside the knowing the amount hence has to be paid back while the EMI when you get the new patch loan. Everything you need to create are enter the amount borrowed, period in the months, the interest rate in addition to control percentage and click to the Calculate’.

What’s Plot Mortgage?

Patch funds was a unique banking tool made to support this new acquisition of a parcel. Also known as property loans, it has been mislead as actually just like a mortgage. The difference between patch and you can home loans is the fact a land loan will be availed on purchase of the fresh new home where our home would be developed later on.

- Might be availed for sale from residential property

- Glamorous interest rates

- Reasonable fees tenures

- Zero pre-payment punishment

- Control payment try lowest

- Minimal files

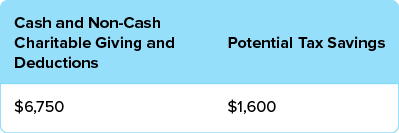

- Taxation benefit less than Part 24 and 80C of cash Income tax Work

What is the Eligibility Criteria for Area Loan?

- Should be a resident Indian

- Is going to be a great salaried or worry about-working applicant

Which are the Data files Necessary to Apply for Patch financing?

Here is the range of very first records which you commonly have to furnish when you are trying to get a story mortgage. The latest documentation conditions try subject to change with regards to the qualifications requirements put off by various other financing associations.

Ways to get Income tax Exempted from Area Loan?

Taxation pros on the plot funds shall be availed only if your create property on the area. The taxation write-offs is appropriate only if the construction is done. According to Part 80C of one’s Income tax Act, you might avail deduction to your principal fees parts to a maximum of Rs.step 1.50 lakh per year.

You can also find tax experts on attract percentage of the loan below Section 24 shortly after structure of the property are accomplished therefore initiate remaining in our home. Around Point 24 of one’s Tax Act, you are qualified to loans for law school receive a yearly deduction out of Rs.dos lakh. Although not, in order to get that you should move the latest plot loan into the a typical home loan.

Which are the differences when considering Area Loan and you can Home loan?

Patch fund is approved only for the acquisition from a domestic plot of land and when this new debtor has actually specified plans of strengthening a home to the parcel. Financial institutions usually have an extent within this that belongings has actually as done on purchased property. not, because house might have been done, the culmination otherwise occupancy certificate may then become submitted to the fresh new financial and the latest plot loan might possibly be turned into good typical financial. Thus giving the new borrower new liberty to try to get taxation masters into the mortgage given that plot loans dont qualify for people taxation write-offs.

A good credit score is very important locate brief and you may issues-totally free approvals to possess land financing. not, when you yourself have less than perfect credit, you could potentially still desire to get a secure loan sanctioned out of a financial by using a combined mortgage that have a partner since your co-candidate, bringing your wife enjoys a leading credit history and you can a regular source of income. It is possible to method the bank for a loan immediately after boosting your credit score, that can be done from the clearing your past expense. You are able to strategy a lender with which you have got an present relationship or repaired deposits or other financial investments.

Sure, Non resident Indians qualify to have spot loans from banks in the Asia. Although not, the newest spot financing can just only be employed to get a story of land to own home-based explore and cannot be studied when it comes down to other goal.