How to perform lease & mortgage payments when you find yourself strengthening my personal earliest domestic?

When building the original family your home loan means will vary to purchasing a reputable possessions or a finished the new property. From the FHBA, we realize one building a fresh house is a famous choice for earliest home buyers trying gain benefit from the state gives and you can concessions that are offered. Now we take a closer look from the specific factors when financing a home getting founded.

Normally, once you enter into a contract to create your first household, you need to apply for a beneficial Build Loan’. He’s a different sort of loan design to help you lenders available for anyone to shop for an existing home. A casing loan enjoys a couple of breaks:

- The mortgage with the belongings component (in case it is a torn bargain between your homes and you can design)

- The construction role since it is getting pulled off to own improvements costs

Lenders will have to be sure you normally service both parts after a complete loan amount might have been drawn-off, we.e. in the event the property is completely over and ready to move into.

What happens if i was leasing although the strengthening my personal very first home?

When you’re fortunate enough to-be living at your home while the creating your first household then you may not be too alarmed regarding keeping your structure financing costs using your latest life style preparations. not, not every one of all of us is one happy and many of us have to rent sometimes because of performs otherwise household members grounds. Probably one of the most frequently asked questions out of ambitious very first house consumers we get is How to perhaps manage to create my personal mortgage payments as the I am strengthening and you will rescuing to possess my very first domestic put?’

- Cutting your cost of living to be sure you can afford to expend their rent & meet the loan payments

- Swinging home or renting a less expensive property with this stage

- Going for a creator that can done design within a few days (i.age. 4-six months)

not, basic homebuyers could be very happy to remember that loan providers is plus make it easier to. Sure that is right lenders can still care for you when you need these to really!

Just how can loan providers help in allowing fhb’s to keep up loan payments whenever you are leasing?

First home buyers is shocked to understand that lenders create delight in just how difficult individuals obtain it when building property, specifically if you is renting at the same time! Luckily, the majority of lenders that provide build loans will allow very first home customers to minimize their repayments in structure chronilogical age of their earliest family or even for the original season of the financial label.

Just how precisely manage loan providers do that? Loan providers assists that it by permitting earliest homebuyers while making Appeal Only’ repayments sometimes from inside the design period (i.e. through to the house is willing to move into) or because mortgage has reached the initial 12 months wedding.

On the mass media, basic home buyers might have been aware of most of the publicity toward interest-only fund and exactly how brand new authorities was basically breaking upon these types of before for the 2017. Even though the focus-simply lending is something the lenders are attempting to avoid, they are still extremely accommodative regarding giving attention-only loans in order to very first home buyers that are design their very first family.

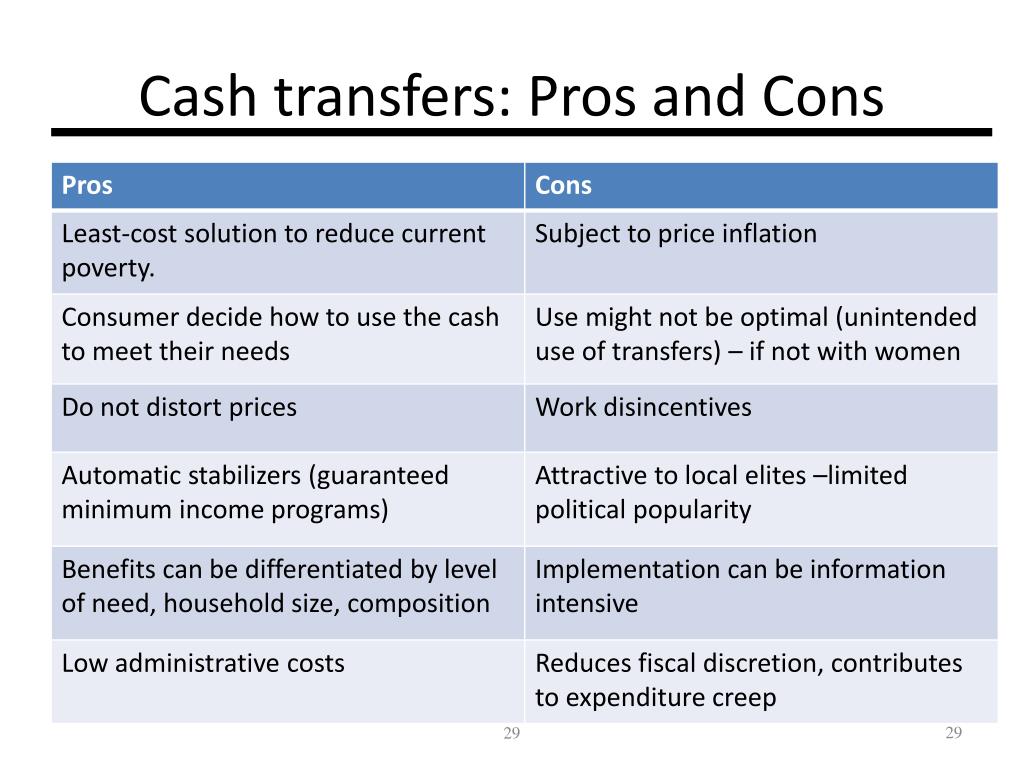

We shall fool around with an easy example evaluating dominating & focus payments (paying down attract in addition to mortgage harmony down) so you can attract-just money less than:

If you are searching at the acquiring good $400,100 financing for your earliest household after that your repayments for a good Dominant & Attention (P&I) loan’ can be as pursue:

If you are searching at the acquiring an effective $400,100 mortgage for the very first house after that your payments having a keen Appeal Just loan’ will be as observe:

- 4% Interest rate

- $400,100 mortgage

- Lender provides an equivalent P&We and you will attention simply rates

- Residential property rates try $200,100 and you can structure rates try $two hundred,one hundred thousand

Once we can see on the over evaluation between attract only & P&I payments, basic homebuyers can help to save whenever $250 within the weekly payments through getting an interest just loan more being https://paydayloancolorado.net/montrose/ required to get an excellent P&We loan. Here is the preferred means first homebuyers across the Australian continent use in buy to cover to create one to fantasy earliest household whilst renting in their current host to residence.

Particular loan providers can charge increased attract just interest in review into the P&I rates available, but not, all of our very first household customer Brokers/Coaches on FHBA Mortgages have access to lenders who’ll render an identical rate of interest into the a destination-simply framework financing given that an excellent P&We financing while the structure is complete.

Our very own educated basic household visitors specialist brokers can identify how interest only financing really works and more importantly, exactly what your repayments will particularly while leasing. After all, we know this is your first-time delivering that loan, not to mention a casing mortgage! Just click right here so you can book your cost-free consultation today!