Be it using matrimony or cohabitation, there appear a place in the most common major relationships when we begin talking bank account and you may savings profile, resource strategies and later years agreements. Therefore the big concern: Is to people split expense ?

Here’s the issue: Every day life is tricky, and money was dirty. You make more they do. He’s significantly more loans than you will do. You really have student education loans to invest; he’s kid service money to keep up with. You’re signing up for lives, but consolidating assets could be the very tricky section of one do it. Since the while you are the relationship would be a relationship, your finances most likely is not. However, by the maintaining truthful, discover communications about your expenses and you may income, doing an idea that really works for of you despite your own money luggage and being repaired on the a shared mission, you might steer clear of the No. 1 reason dating fail in the first place: matches throughout the money.

In a survey from the Ohio County College or university, experts discovered that arguing regarding cash is undoubtedly the top predictor regarding whether or not one or two will get separated. People objections have a tendency to take longer to recover from consequently they are a lot more extreme, boffins told you. Nevertheless they usually last much longer than fights over the kids, gender or even in-laws and regulations. So, whether you’re simply transferring to the latest economic part of your relationships otherwise you’ve been charting the fresh new oceans for some time, this is how you could guarantee equity and steer clear of financial unexpected situations.

What you should Talk about

- Your personal, Exploit and you can Ours

- Imagine if That Tends to make More?

- Deciding Whom Covers What

- Protecting for future years

- How-to Dedicate

- Divvying Up Commitments

Your, Mine and you will Ours

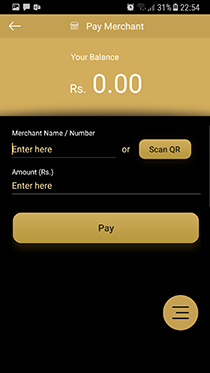

In 2-earnings couples, the best options is to has actually private levels where one another partners take care of her possessions then again enjoys a mutual membership one one another https://www.cashadvancecompass.com/payday-loans-il/nashville/ financing to blow common costs. This is the least difficult means to fix show the latest monetary load regarding day-to-go out expenditures while maintaining monetary independence, states Emily Sanders, handling manager from United Financial support Financial Advisers inside Atlanta.

We worked with lovers regarding decades twenty two to help you ninety-five, Sanders says. And lots of of the very most cheerfully married people I have seen are ones one to leftover their cash independent due to their entire relationship. It requires away some of the strength and you can manage issues that include of how exactly we explore our currency.

A mutual account demands transparency, common faith and reveals a discussed partnership to the a familiar purpose. Sanders including advises including per other’s brands on the flat lease otherwise household deed. It escalates the collateral on dating and you can hinders the latest their house otherwise the lady apartment language. Its a together today, both fulfillment and duty.

Let’s say You to definitely Can make Alot more?

Chances are that you plus lover usually earn additional wages, and those wide variety might run the gamut. Therefore could it be fair if that’s the case to break the mortgage ? No. Reasonable doesn’t necessarily suggest equal, states Kelley Enough time, person in brand new National CPA Financial Literacy Payment.

Instead, A lot of time states, perform some math. Generate a listing of any shared expenses: houses, taxes, insurance rates, utilities. After that cam paycheck. If you make $60,100000 and your companion can make $40,100000, you then will be pay 60 percent of this total towards the fresh new common costs and your mate 40 percent. By way of example, if for example the lease try $step one,one hundred thousand, you only pay $600 as well as your spouse contributes $eight hundred.

To accomplish this rather and equitably, provides both you and your mate set-up a primary deposit from the personal profile for the shared shared account for the concurred show of expenditures. Right after which feedback the lending company report each month for that account as well as the expense which might be coming in. Transform goes. This new cable supply bill goes up; the brand new gasoline bill exceeds requested. Be ready to adapt to alter and keep some cash for the put aside on your personal levels to fund people unexpected overages.